Trusted by Thousands of Businesses Across Canada

Discover a Simple Way to Process Payroll

Running payroll for small and medium-sized businesses can be a time-consuming challenge, often diverting your attention from crucial tasks such as marketing, sales, operations, and customer service.

Our online payroll software for small businesses allows you to effortlessly manage payroll, ensuring your employees receive timely compensation without the hassle. Additionally, you can focus on growing your business and ensuring client satisfaction.

Manage Online Payroll like a Pro

Run Payroll Anytime, Anywhere

Enjoy the freedom of managing your payroll from anywhere, anytime—whether you're at the office, home, or on the go.

ACH Direct Deposit & Cheques

Pay your employees with ACH direct deposit or cheques, ensuring that they receive their compensation securely and promptly.

Accurate Payroll Processing

Handle complex calculations effortlessly, minimizing errors and ensuring that your employees are paid accurately and on time, every time.

Flexible Payroll Options

Customize your payroll process, incomes, and deductions to align seamlessly with your organization's requirements and policies.

Affordable Pricing

Our affordable pricing plans cater to businesses of all sizes, allowing you to enjoy the benefits of enterprise-level features without breaking the bank.

RL-1 and T4 Filing

Our software takes the hassle out of tax compliance by generating accurate and compliant RL-1 and T4 forms.

Enjoy the freedom of managing your payroll from anywhere, anytime—whether you're at the office, home, or on the go.

Pay your employees with ACH direct deposit or cheques, ensuring that they receive their compensation securely and promptly.

Handle complex calculations effortlessly, minimizing errors and ensuring that your employees are paid accurately and on time, every time.

Customize your payroll process, incomes, and deductions to align seamlessly with your organization's requirements and policies.

Our affordable pricing plans cater to businesses of all sizes, allowing you to enjoy the benefits of enterprise-level features without breaking the bank.

Our software takes the hassle out of tax compliance by generating accurate and compliant RL-1 and T4 forms.

Run Payroll in 3 Easy Steps!

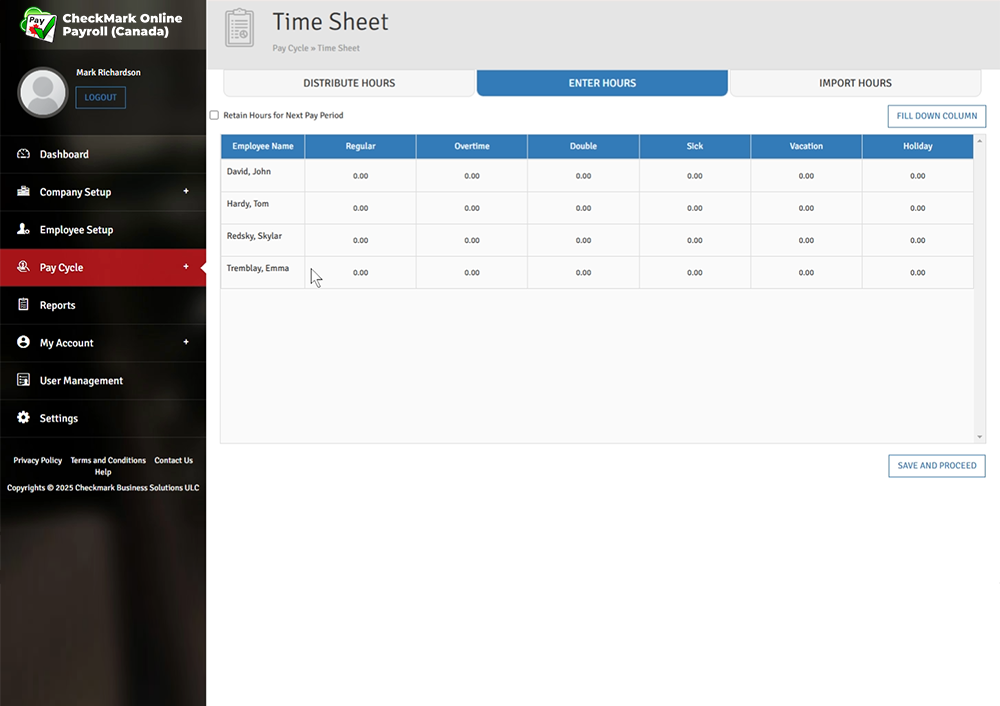

Enter Hours

Add payroll hours, select pay period, and pay date.

Process Payroll

Review and approve payroll details for one or all employees.

Pay Employees

Transfer funds directly with ACH direct deposit or issue cheques.Ideal for Small Businesses Across Industries

Architect

Architect

Startups

Startups

Accounting firms

Accounting firms

Healthcare

Healthcare

Creative Agencies

Creative Agencies

Education

Education

Wholesalers

Wholesalers

Construction/Real estate

Construction/Real estate

Home Services Provider

Home Services Provider

Manufacturing

Manufacturing

Publishing House

Publishing House

Restaurants

Restaurants

Legal

Legal

Non-Profits

Non-Profits

Media

Media

Telecommunication

Telecommunication

Retailers

Retailers

Travel Agent

Travel Agent

Photography

Photography

Contractor

Contractor

Consulting

Consulting

Architect

Architect

Startups

Startups

Accounting firms

Accounting firms

Healthcare

Healthcare

Creative Agencies

Creative Agencies

Education

Education

Wholesalers

Wholesalers

Construction/Real estate

Construction/Real estate

Home Services Provider

Home Services Provider

Manufacturing

Manufacturing

Publishing House

Publishing House

Restaurants

Restaurants

Legal

Legal

Non-Profits

Non-Profits

Media

Media

Telecommunication

Telecommunication

Retailers

Retailers

Travel Agent

Travel Agent

Photography

Photography

Contractor

Contractor

Consulting

Consulting

Transforming How You Process Payroll

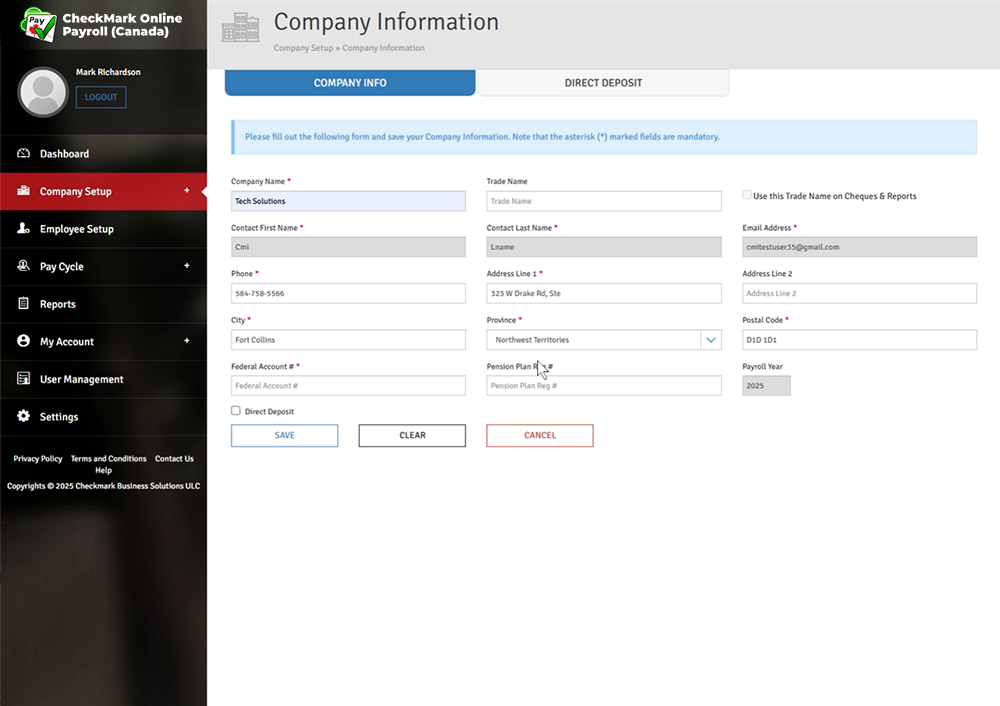

Set up your company in a matter of minutes

With nothing to download or install, getting started with Online Payroll is easy with the step-by-step company setup flow.

- Create your company with minimum requirements like the company’s name, address, Federal Account No. etc.

- Choose the direct deposit option and enter your bank and business information to process your employee pay cheques and tax payments.

- Set up for up to 99 departments and unlimited job titles.

- Loaded with the latest tax tables and legislative updates. One-click option for loading the latest tax values.

- Easily edit provincial WSIB and EHT values.

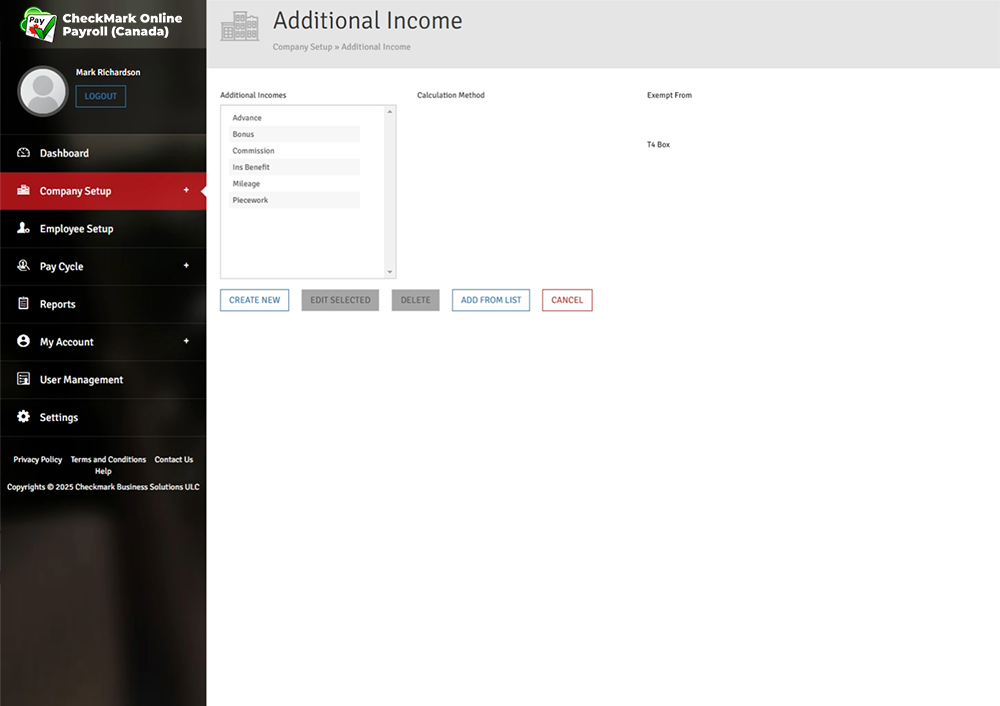

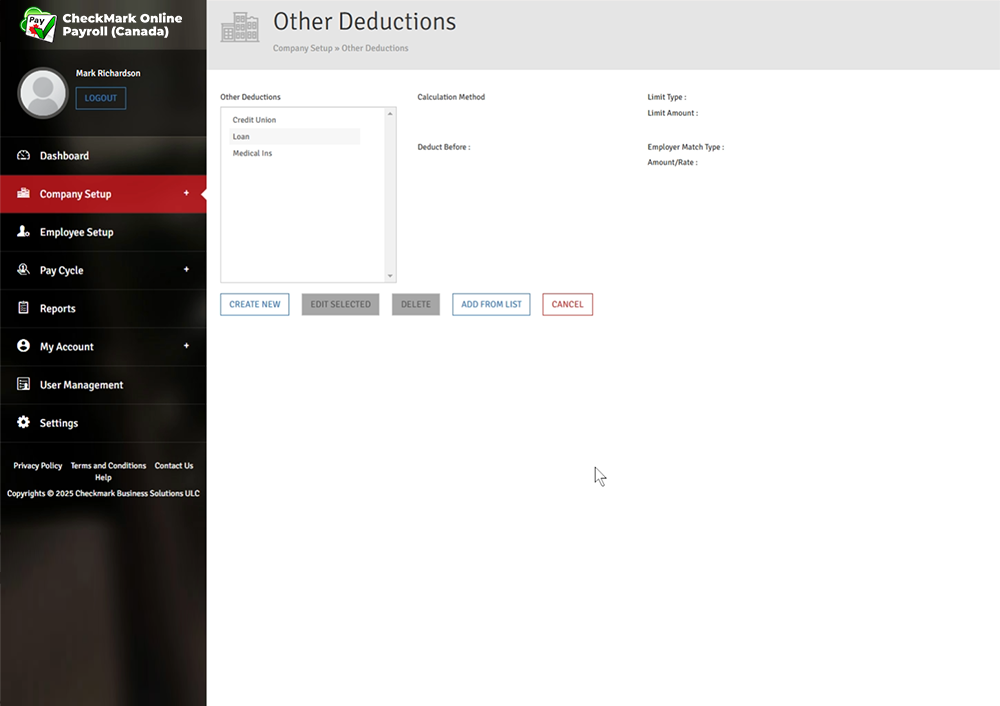

- Set up or override default values for commonly used information for Hourly categories, Additional Incomes, and Other deductions.

- Define incomes and deductions for nearly every need.

- Ledger Account Setup allows the ability to have different tax expense accounts by department.

Add employees just like a breeze

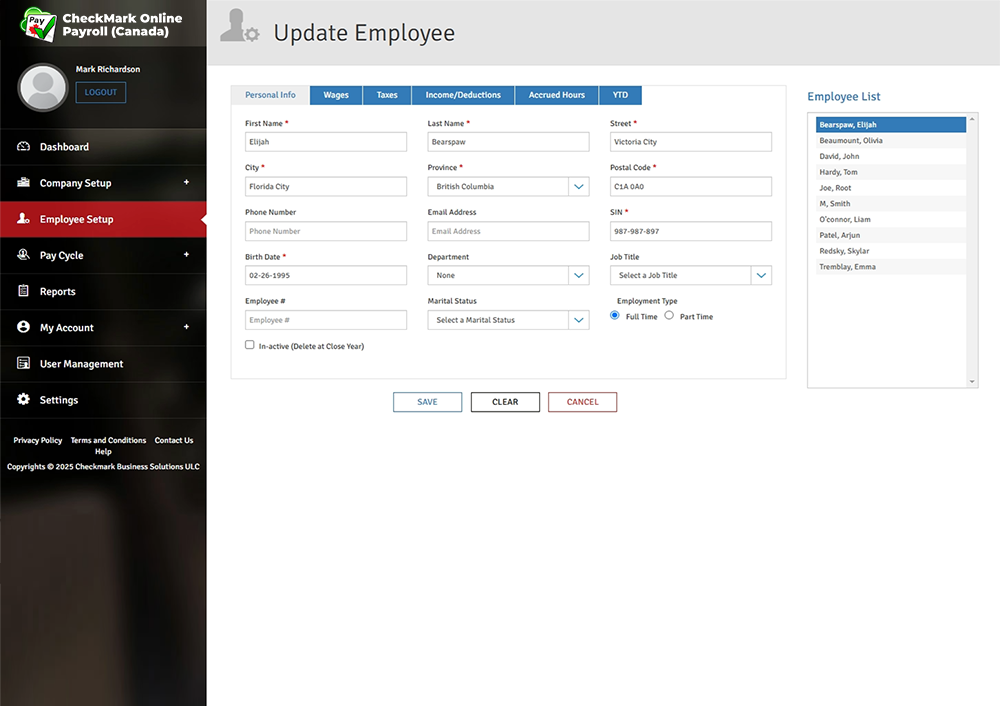

CheckMark Online Payroll Software allows you to add or edit employees easily with just a few steps.

- Add, manage, and edit unlimited employees.

- Import employees in CSV or Tab-delimited text format.

- Set up employees’ personal, wage, and tax information with ease.

- Add bank account details to process direct deposits.

- Assign additional incomes, other deductions, accruals, etc.

Process Payroll like never before

Payroll can be a painful and time-consuming process, but with CheckMark Online Payroll, you can process payroll easily in minutes, not days!

- Select from multiple pay periods – daily, weekly, bi-weekly, semi-monthly, monthly, quarterly, semi-annually, and annually.

- Enter employee hours in a spreadsheet-style window.

- Import/export hours from a text file, CSV file, or time clock.

- Pay your employees through direct deposit.

- Run after-the-fact payrolls or single cheques.

- Accrues sick and vacation time.

Generate reports at your fingertips

CheckMark Online Payroll (Canada) provides a wide range of standard reports that you can view, print, or export with ease.

- Export reports in CSV or plain text files.

- Create and print T4 and RL-1 forms.

- Generate T4 summary and T4 XML file for e-filing.

- Generate EI and QPIP deduction reports.

- Allows users to distribute employee hours or wages by department.

- Tax breakdown by individual department for posting summary.

- Individual department earnings register, employee wage and hour details.

- Employee earnings are separated by Earnings Register and Hours Register.

- Integrates data with MultiLedger, Moneyworks, and many other accounting programs.

#1-Rated Online Payroll Software

Designed to Give You Peace of Mind

Simple and Easy Interface

Take total control of your payroll through an intuitive, simple, and easy-to-use online interface. With a responsive desktop and mobile design, CheckMark Online Payroll (Canada) is ready to use wherever you are.

100% Secure and Encrypted

Your sensitive payroll data is securely stored in sophisticated servers, and fully protected with powerful firewalls and state-of-the-art encryption techniques used by banking institutions.

Access Your Payroll Data 24/7

You can access your payroll data wherever and whenever you need. Process payroll, access data, and generate reports when needed.

Free World-class Customer Support

Our Canada-based support team consists of industry experts and friendly payroll professionals. No matter what you need, we're here to help you do payroll with peace of mind.

Forget Annual Updates

Online Payroll Software is always up to date, and there are no annual updates to purchase and download. Now, there is no need to remember the dates of annual updates.

Save More Time

Say goodbye to simple administrative payroll tasks, and get more time to focus on growing your business to the next level.

Take total control of your payroll through an intuitive, simple, and easy-to-use online interface. With a responsive desktop and mobile design, CheckMark Online Payroll (Canada) is ready to use wherever you are.

Your sensitive payroll data is securely stored in sophisticated servers, and fully protected with powerful firewalls and state-of-the-art encryption techniques used by banking institutions.

You can access your payroll data wherever and whenever you need. Process payroll, access data, and generate reports when needed.

Our Canada-based support team consists of industry experts and friendly payroll professionals. No matter what you need, we're here to help you do payroll with peace of mind.

Online Payroll Software is always up to date, and there are no annual updates to purchase and download. Now, there is no need to remember the dates of annual updates.

Say goodbye to simple administrative payroll tasks, and get more time to focus on growing your business to the next level.

Enterprise-Level Features for Small Businesses

Multiple Pay Frequencies

Select from multiple pay frequencies which one is best for your business and employees. CheckMark Online Payroll (Canada) supports daily, weekly, bi-weekly, semi-monthly, monthly, semi-annual, and annual pay frequencies.Hourly and Salary Payroll

Whether you’re paying your first employee or a whole company, Online Payroll Software makes it extremely easy to pay both hourly and salaried employees.T4 and RL-1 Reports

View and print T4 and Relevé 1 information on standard or laser T4 and Relevé 1 forms. Generate T4 XML file for electronic filing.Additional Incomes and Deductions

Define and calculate up to 20 benefits and 30 other deduction categories for your company. Assign up to four benefits and eight deductions per employee.

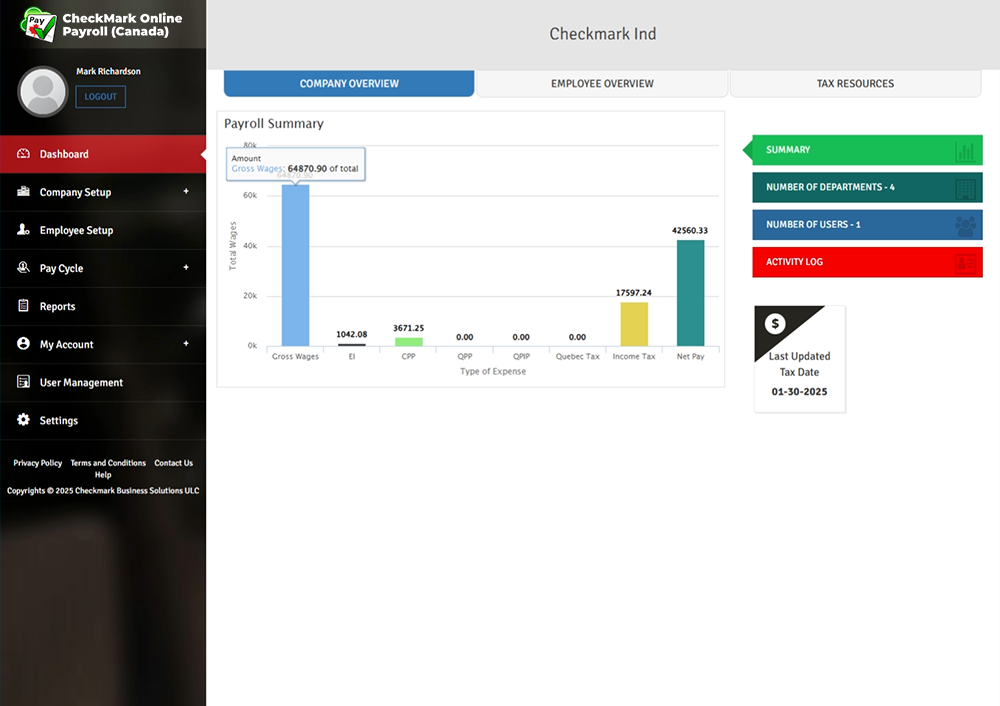

Experience CheckMark Online Payroll Software

Effortlessly manage your company, employees, payroll processing, and reports from our user-friendly dashboard.

Print your cheques and reports using a Company or Trade Name—whichever suits your needs best.

Print your cheques and reports using a Company or Trade Name—whichever suits your needs best.

Customize up to 20 additional income categories for your company and assign up to 4 per employee. Choose from pre-set categories, modify them, or create your own.

Customize up to 20 additional income categories for your company and assign up to 4 per employee. Choose from pre-set categories, modify them, or create your own.

Set up to 30 deduction categories for your company and assign up to 8 per employee. You can also configure an Employer Match for added flexibility.

Set up to 30 deduction categories for your company and assign up to 8 per employee. You can also configure an Employer Match for added flexibility.

CheckMark Online Payroll (Canada) supports an unlimited number of employees. Manage active and inactive employees, track accrued hours, and assign specific incomes and deductions for each employee.

CheckMark Online Payroll (Canada) supports an unlimited number of employees. Manage active and inactive employees, track accrued hours, and assign specific incomes and deductions for each employee.

Input hours using a spreadsheet-like format or import them from a tab-delimited text file or a .CSV file.

Input hours using a spreadsheet-like format or import them from a tab-delimited text file or a .CSV file.

Here Is What Our Customers Have to Say

![]()

![]()

Stress-Free Payroll Setup

We started using CheckMark Online Payroll about a year ago when we moved away from manual payroll. It’s been a huge time-saver. I don’t have a background in payroll, but the platform is intuitive and makes things really straightforward. I especially appreciate the automatic tax calculations.

Jasmine, Manitoba![]()

![]()

Perfect for Small Business

For a small business like ours with seasonal workers, CheckMark has made a big difference. I can easily add or remove employees, and the cloud access means I can run payroll even when I’m out in the field. Customer support was responsive and helpful.

Scott, British Columbia![]()

![]()

CRA-Compliant

We’ve been using CheckMark for payroll since launching our agency. It helps us stay CRA-compliant and simplifies the entire payroll process. As the payroll manager, I find the cloud-based system easy to access and efficient to use. Generating T4s at year-end was quick and hassle-free.

Meera, Nova Scotia![]()

![]()

Reliable, No-Frills Payroll

I manage payroll for a dozen employees, and CheckMark Online Payroll has taken the headache out of deductions and remittances. It’s not flashy, but it’s reliable and accurate. I’d recommend it to anyone who needs solid payroll software without paying enterprise-level prices. The setup had a bit of a learning curve for me, but the support team was awesome and helped me get up to speed quickly. Since then, it’s been running like clockwork.

Daniel, AlbertaFrequently Asked Questions

Yes, you can access CheckMark Online Payroll (Canada) from any location and device with an internet connection. The software is web-based, allowing for convenient access wherever you are.

There is no setup fee for CheckMark Online Payroll (Canada). Setting up the software for your business typically takes just a few minutes with the assistance of our software manual and support team.

You can begin using our online payroll software at any point in the year. Simply enter year-to-date totals for your employees up to the last completed quarter, then enter after-the-fact cheques for the current quarter, and you're ready to go!

Yes, CheckMark Online Payroll (Canada) is designed to comply with payroll regulations in your relevant jurisdiction, providing accurate calculations and ensuring compliance with legal requirements.

Yes, our online software includes features for tracking employee time off, including vacations and sick leave. You can set up and manage various types of leave within the system.

Yes, you can generate and print pay stubs for employees for each pay period directly from our software.

CheckMark Online Payroll (Canada) employs robust security measures to protect your company's data. We have partnered with industry-leading security companies to ensure your payroll data is protected by sophisticated servers, powerful firewalls, and advanced encryption techniques used by banking institutions.

Yes, CheckMark Online Payroll (Canada) automatically handles payroll tax calculations based on the latest tax tables and legislative updates. This ensures accurate and compliant payroll processing.

Yes, CheckMark Online Payroll (Canada) allows you to generate tax forms, such as T4 and RL-1 forms, for reporting purposes. You can easily generate and download these forms for filing with the relevant authorities.

The free trial for CheckMark Online Payroll (Canada) allows you to explore all the features of the software for a limited period of 15 days. During the trial, you have full access to all features and functionalities. These include:

- A sample company with pre-filled data to help you familiarize yourself with the platform.

- The ability to add up to 25 employees to your payroll.

- Create up to 500 cheques to process payments for your employees.

- Run unlimited payroll cycles to ensure you can fully test the payroll processing functionality.

No, there is no limit to the number of employees you can add to your payroll using CheckMark Online Payroll (Canada). You can add unlimited employees to your account.

No, there are no hidden fees or setup charges associated with CheckMark Online Payroll (Canada). The pricing is transparent, and there are no additional costs beyond the subscription fee.

Yes, ACH direct deposit for employees is included in the subscription cost for CheckMark Online Payroll (Canada). You can transfer salaries directly to your employees' accounts without any additional charges.

Streamline Your Payroll in the Cloud with CheckMark

Affordable Online Payroll Software Tailored for Canadian Businesses of All Sizes.

Start Your Free Trial Now